Categorisation of Financial Products Under SFDR: A Detailed Overview

The European Commission’s Platform on Sustainable Finance has released a proposal that provides essential guidance for categorising financial products under the Sustainable Finance Disclosure Regulation (SFDR). This document outlines a structured approach aimed at enhancing transparency and consistency in sustainable finance markets. The insights detailed here are derived from the initial 26 pages of the official proposal, focusing on foundational principles, key categorisation criteria, and implications for market participants.

1. Background and Context

The SFDR, introduced as part of the European Union’s broader sustainable finance strategy, mandates financial market participants (FMPs) to disclose sustainability-related information. The regulation serves two primary purposes:

- Combatting Greenwashing: By establishing uniform disclosure standards, SFDR reduces the risk of misrepresenting the sustainability profile of financial products.

- Enhancing Comparability: The regulation enables investors to make informed decisions by comparing products based on consistent sustainability metrics.

The categorisation framework proposed by the Platform on Sustainable Finance seeks to address ambiguities in SFDR’s existing implementation. It delineates clear boundaries and criteria for financial products classified under Articles 6, 8, and 9 of the SFDR.

2. Core Principles of the Proposal

The document identifies five core principles underpinning the categorisation framework:

- Alignment with Regulatory Objectives: The categorisation aligns with the overarching goals of the SFDR, including transparency, investor protection, and market integrity.

- Consistency with the Taxonomy Regulation: Products must demonstrate adherence to the EU Taxonomy’s technical screening criteria, where applicable.

- Focus on Materiality: The framework emphasises the material impact of sustainability objectives on financial products, ensuring relevance and accountability.

- Proportionality: The requirements are tailored to the size and scale of market participants to avoid disproportionate compliance burdens.

- Flexibility: The framework accommodates innovation and evolution in sustainable finance practices.

3. Key Categorisation Criteria

The categorisation framework distinguishes between the three primary categories of financial products under SFDR:

| Article 6 Products | Article 8 Products | Article 9 Products | |

|---|---|---|---|

| Definition | Products that do not integrate sustainability objectives as a core feature but provide basic transparency on sustainability risks. | Products that promote environmental and/or social characteristics while ensuring good governance practices. | Products with sustainable investment as their explicit objective. |

| Key Requirements |

|

|

|

| Target Audience | Investors seeking conventional financial returns with limited consideration of sustainability factors. | Investors prioritising balanced financial and sustainability outcomes. | Investors seeking to allocate capital toward high-impact sustainable investments. |

4. Challenges Addressed by the Proposal

The proposal acknowledges key challenges faced by stakeholders in implementing SFDR requirements:

| Ambiguity in Definitions | Investors seeking conventional financial returns with limited consideration of sustainability factors. |

|---|---|

| Data Availability | Limited access to reliable and comparable data hinders compliance and decision-making. |

| Integration with Other Regulations | Ensuring coherence with the EU Taxonomy and broader ESG regulations requires meticulous alignment. |

The categorisation framework provides clarity on these issues, ensuring that market participants can comply with SFDR requirements while maintaining operational efficiency.

5. Implications for Financial Market Participants

Market participants must assess their product portfolios against the categorisation framework to determine appropriate classification and disclosure requirements. Key actions include:

- Conducting gap analyses to identify discrepancies between existing disclosures and proposed criteria.

- Enhancing data collection and reporting mechanisms to meet transparency obligations.

- Training internal teams to ensure alignment with regulatory expectations and mitigate risks of non-compliance.

6. Indicators to Be Used

The effective application of sustainability indicators is fundamental to the implementation of SFDR requirements. Indicators serve as measurable data points that enable financial market participants (FMPs) to assess, compare, and report the environmental, social, and governance (ESG) impacts of their financial products. The proposal provides detailed guidance on the selection, implementation, and reporting of these indicators, ensuring alignment with the EU’s sustainable finance objectives.

Types of Indicators

| Environmental Indicators | ||

| Carbon Footprint |

|

|

| Water Usage Efficiency |

|

|

| Waste Management |

|

|

| Social Indicators | Labour Practices |

|

| Community Engagement |

|

|

| Governance Indicators | Executive Remuneration |

|

| Ethical Business Practices |

|

Methodological Framework for Indicators

| Selection Criteria |

|

|---|---|

| Data Sources |

|

| Reporting Standards | Align with established frameworks such as GRI, SASB, or the TCFD. |

Role of Indicators in Principal Adverse Impacts (PAIs)

Indicators form the backbone of PAI reporting by providing measurable data on the adverse sustainability impacts of investments. The proposal specifies:

- Mandatory Indicators: Core metrics such as GHG emissions, biodiversity impacts, and water consumption must be included for transparency.

- Supplementary Indicators: Optional metrics tailored to specific sectors or client preferences can enhance disclosures.

- Transparency: Detailed methodologies, including data sources and assumptions, must be disclosed for each indicator.

7. Sustainability Preferences and Clients’ Needs

The integration of sustainability preferences into financial products is not merely a compliance requirement but a means of fostering client trust and achieving sustainability objectives. The proposal outlines how FMPs can systematically align product offerings with client preferences while maintaining regulatory adherence.

Addressing Sustainability Preferences

| Preference Elicitation | Structured Questionnaires | Develop comprehensive surveys to capture client preferences for specific sustainability objectives, such as climate action, biodiversity preservation, or social equity. |

|---|---|---|

| Advisory Tools | Use decision-support systems that guide clients through the process of identifying their sustainability priorities. | |

| Integration into Product Design | Customised Portfolios | Construct portfolios that align with client-stated objectives, integrating both positive screening (selecting sustainable investments) and negative screening (excluding harmful industries). |

| Dynamic Adjustments | Enable real-time portfolio adjustments based on changes in client preferences or regulatory updates. | |

| Transparency and Communication | Impact Reporting | Provide periodic reports detailing the alignment of investments with client preferences, supported by quantitative data and visual dashboards. |

| Education | Offer educational resources to help clients understand the implications of their sustainability preferences on investment outcomes. |

Monitoring and Review Mechanisms

- Periodic Reviews: Reassess client preferences at regular intervals to ensure continued alignment with financial products.

- Feedback Loops: Establish mechanisms for clients to provide input on the performance and alignment of their investments with stated preferences.

8. Disclosure and Naming

The naming conventions and disclosure requirements under SFDR are designed to enhance investor clarity and confidence. The proposal provides a detailed framework for ensuring that product names and disclosures accurately reflect their sustainability objectives.

Naming Rules

| Article 6 Products |

|

|---|---|

| Article 8 Products |

|

| Article 9 Products |

|

Disclosure Requirements

| Pre-Contractual Disclosures |

|

|---|---|

| Periodic Reporting |

|

Monitoring and Compliance

- Third-Party Audits: Engage independent auditors to validate the accuracy of disclosures and naming practices.

- Regulatory Oversight: Implement mechanisms for monitoring compliance, with penalties for misleading claims or inadequate disclosures.

9. Process of Categorisation

The categorisation of financial products under the Sustainable Finance Disclosure Regulation (SFDR) is a rigorous and methodical process. It ensures that products are transparently classified based on their sustainability characteristics, promoting consistency across the market and adherence to regulatory requirements. This section outlines the categorisation framework and delineates responsibilities and assurance mechanisms to maintain the integrity of the process.

Introduction of Categorisation Scheme

The categorisation scheme provides a structured methodology to classify financial products into SFDR categories (Articles 6, 8, and 9). This framework ensures clarity for investors and compliance with the EU’s sustainable finance objectives.

Steps in the Categorisation Process

| 1 | Preliminary Product Analysis |

Example: A green bond fund investing primarily in renewable energy projects may qualify as Article 9 if it explicitly aims to reduce carbon emissions. |

| 2 | Alignment with EU Taxonomy |

|

| 3 | Indicator Integration | Establish relevant and measurable indicators to evaluate the product’s performance against sustainability objectives. Examples include:

|

| 4 | Disclosure Preparation |

|

| 5 | Validation and Review | Conduct internal reviews to ensure the product’s classification aligns with SFDR requirements and the EU Taxonomy. Any deviations must be documented and rectified promptly. |

Benefits of the Scheme

- Consistency: Establishes uniform criteria across the market, enhancing comparability.

- Investor Confidence: Provides clear and accurate sustainability claims to build trust.

- Regulatory Compliance: Streamlines adherence to SFDR and EU Taxonomy requirements.

10. Responsibilities and Assurance

The successful implementation of the categorisation scheme depends on the defined roles and responsibilities of stakeholders and robust assurance mechanisms to uphold transparency and accountability.

Stakeholder Responsibilities

| Stakeholder | Responsibility | Description |

|---|---|---|

| Financial Market Participants (FMPs) | Data Collection |

|

| Product Classification |

|

|

| Disclosures | Prepare detailed pre-contractual and periodic disclosures, ensuring alignment with SFDR templates. | |

| Independent Auditors | Verification of Sustainability Claims | Conduct audits to validate the accuracy of sustainability metrics, taxonomy alignment, and disclosures. |

| Compliance Assurance | Confirm that the categorisation process adheres to SFDR and EU Taxonomy standards, highlighting any discrepancies. | |

| Regulators | Monitoring and Oversight | Regularly review FMPs’ disclosures and sustainability claims to ensure compliance. |

| Enforcement | Impose penalties for misleading claims or non-compliance with the categorisation framework. |

Assurance Mechanisms

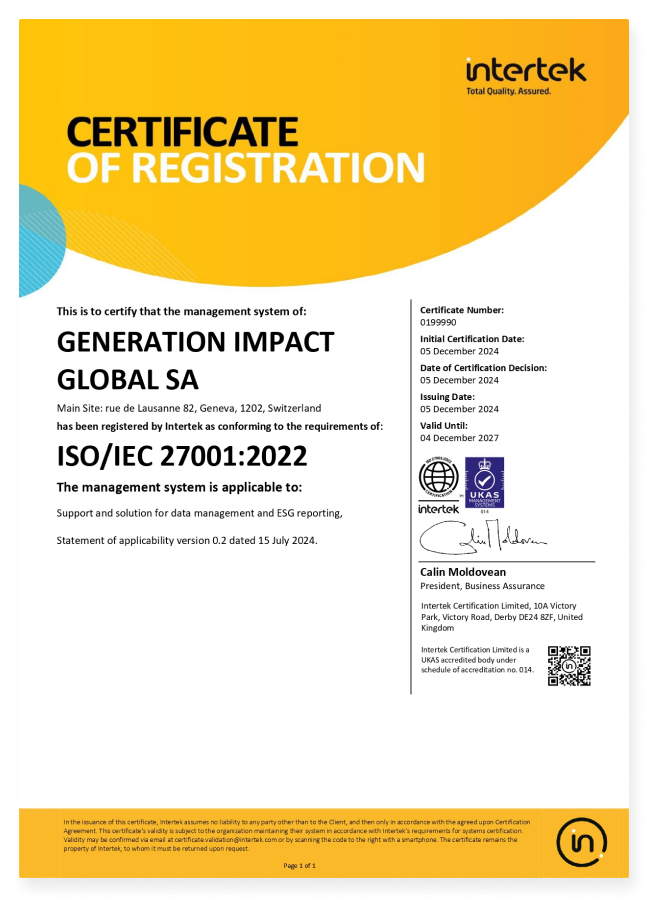

- Third-Party Certification:

- Engage ESG certification agencies or consultants to independently assess and verify sustainability claims.

- Example: Certification from a recognised body on the alignment of a green bond fund with the EU Taxonomy.

- Internal Governance:

- Establish dedicated sustainability committees or officers to oversee the categorisation and disclosure processes.

- Implement robust internal controls to prevent errors or inconsistencies.

- Technological Integration:

- Use advanced tools, such as blockchain for data traceability or AI for predictive analytics, to enhance the reliability of sustainability data and streamline reporting.

- Feedback Mechanisms:

- Develop channels for receiving feedback from stakeholders, including investors and regulators, to continuously refine categorisation processes.

Continuous Improvement

- Regular Updates: Reassess product classifications periodically to align with evolving regulatory standards or market developments.

- Training Programs: Equip teams with up-to-date knowledge on SFDR requirements, EU Taxonomy criteria, and best practices for sustainability reporting.

11. Guidance on Setting Thresholds and Supporting Data

| General Data Overview | Liquid Funds Classified as Article 8 and 9 |

|

| Terms and Fund Names |

|

|

| Asset Class Splits |

|

|

| Sustainable Category – Contribution | SI Performance |

|

| Taxonomy Data for Public Market Funds |

|

|

| Taxonomy Data in General Accounts |

|

|

| Sustainable Category – Do No Significant Harm (DNSH) | Validation |

|

| Transition Category | Definition |

|

| Exclusions | Screening Criteria |

|

12. Principle Aspects and Objectives

- Transparency Principles:

- Ensure all sustainability-related claims are substantiated with robust data and methodologies.

- Avoid subjective or vague claims, instead focusing on measurable and verifiable indicators.

- Integration of Objectives:

- Align fund objectives with SFDR’s dual focus addressing sustainability risks and contributing to sustainability goals.

- Practical Guidance:

- Provide worked examples illustrating how funds align with sustainability objectives and address risks.

13. SFDR vs. IDD/MiFID – Difference in Scope

- SFDR Focus:

Primarily targets financial products and disclosures by FMPs.

- IDD/MiFID Scope:

Focuses on the advisory process and suitability assessments, ensuring that client preferences are incorporated into investment recommendations.

- Harmonisation:

Integrate SFDR-aligned disclosures into MiFID advisory processes, ensuring consistency in client-facing documents.

14. Testing of Categories

- Objective:

- Validate the categorisation framework by testing its application across various financial products and scenarios.

- Testing Methodology:

- Use real-world case studies to assess whether products meet the classification criteria for Articles 6, 8, and 9.

- Identify edge cases where categorisation is ambiguous and provide resolution guidelines.

- Feedback Loops:

- Incorporate feedback from stakeholders and adjust thresholds, indicators, or methodologies to address practical challenges.

15. Conclusion

The categorisation of financial products under the SFDR marks a turning point in aligning the financial industry with sustainability objectives. This framework provides financial market participants with clear, structured guidance to ensure transparency, consistency, and compliance while fostering trust among investors.

By classifying products into Articles 6, 8, and 9, the SFDR not only defines clear boundaries but also enforces accountability through robust data requirements and measurable indicators. This structured approach directly addresses the challenges of greenwashing and fragmented interpretations, paving the way for a more transparent and trustworthy financial ecosystem. The emphasis on alignment with the EU Taxonomy ensures that the framework operates within a scientifically validated and legally cohesive structure, providing a solid foundation for sustainable investments.

Integrating sustainability preferences into product design and ensuring transparency through rigorous disclosure practices underscores the SFDR’s commitment to investor-centric strategies. The guidelines on naming conventions and periodic reporting further strengthen investor confidence by linking claims to measurable outcomes, eliminating ambiguity, and providing clarity.

The annexes serve as a practical toolkit, offering precise thresholds, data requirements, and testing mechanisms to bridge gaps in implementation. By addressing the intricacies of DNSH principles, exclusions, and transition categories, the annexes enable market participants to refine their approaches and adapt to an evolving regulatory environment. The guidance on integrating SFDR with broader frameworks like MiFID ensures coherence across advisory processes and reinforces the role of financial products in achieving global sustainability targets.

Categorisation of Products under the SFDR: Proposal of the Platform on Sustainable Finance (PDF)