ESRS, Double Materiality

Table of contents

Jump to section

Understanding Double Materiality

A Comprehensive Overview

Double materiality, a key concept under European Sustainability Reporting Standards (ESRS), represents a shift in how corporations assess and disclose their sustainability-related impacts. It extends the traditional financial materiality model to both the financial implications of sustainability matters (financial materiality) and the impact of corporate activities on society and the environment (impact materiality). This article delves deeply into the technical and legal framework of double materiality, exploring its implementation within the Corporate Sustainability Reporting Directive (CSRD) and the broader European Union regulatory environment.

Introduction to double materiality

The notion of double materiality was formalized within the CSRD framework and is closely tied to the European Union’s sustainability agenda. At its core, double materiality makes companies to assess and disclose information on:

- Financial Materiality: The effects that sustainability issues, such as environmental risks, may have on the company’s financial performance, position, and prospects.

- Impact Materiality: The effect that a company’s operations have on people, the environment, and broader societal structures.

This dual approach significantly expands the scope of corporate disclosure, ensuring that companies report not only on how sustainability impacts their financial performance but also on how they themselves affect environmental and social contexts.

Regulatory Framework and Legal Foundations

Double materiality under ESRS is mandated by the Corporate Sustainability Reporting Directive (CSRD), an amendment to Directive 2013/34/EU (the Accounting Directive). Articles 19a and 29a of the Accounting Directive outline the requirements for sustainability reporting, emphasizing the importance

of both financial and impact materiality in the assessment process. The CSRD mandates large EU companies and listed SMEs to report on both perspectives of materiality, ensuring comprehensive transparency.

Under the European Financial Reporting Advisory Group (EFRAG), guidelines have been developed to assist companies in implementing these standards. The guidance is designed to complement the CSRD and ESRS, providing practical steps for conducting materiality assessments that comply with legal requirements. Importantly, the EFRAG guidance emphasizes that if any contradiction arises between the guidance and ESRS, the latter takes precedence, highlighting the authoritative nature of ESRS in governing corporate reporting.

The Concept of Double Materiality in ESRS

The ESRS standards incorporate double materiality as a fundamental principle, outlining two distinct but interconnected materiality lenses:

- Impact Materiality: This focuses on how a company’s operations affect external stakeholders, including the environment, human rights, and social systems. Under ESRS, companies are required to report on actual and potential positive and negative impacts over short, medium, and long-term horizons.

- Financial Materiality: This dimension examines how sustainability risks and opportunities, such as climate change or resource scarcity, affect the financial health and viability of the reporting entity. Companies must disclose how these risks could influence their cash flows, access to finance, cost of capital, and overall financial performance.

A key feature of ESRS is its demand for value chain disclosure, which requires companies to account for impacts not only within their own operations but also throughout their supply chains and downstream relationships. This requirement is critical in ensuring that a company’s sustainability footprint is fully accounted for, considering both direct and indirect effects.

Supply chain flows

Dependency

Upstream

Operations

Own

Operations

Downstream

Operations

Material flow

Criteria for Assessing Materiality

The materiality assessment process under ESRS involves several key steps:

- Understanding Context: Companies must first establish an understanding of the business context, identifying relevant sustainability matters that could affect either financial or impact materiality. This involves mapping business relationships and identifying key stakeholders across the value chain.

- Identification of Impacts, Risks, and Opportunities (IROs): This step focuses on identifying all actual and potential impacts related to environmental, social, and governance (ESG) issues. This includes both risks and opportunities that could arise from sustainability matters.

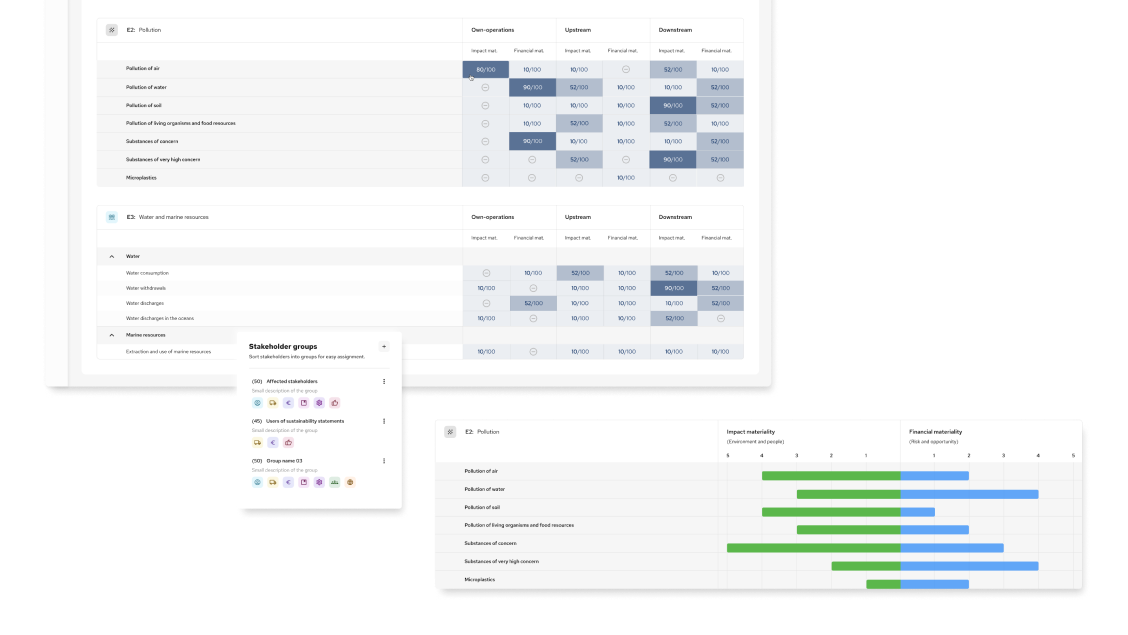

- Assessment of Material IROs: Companies are required to assess the materiality of identified impacts, risks, and opportunities. For impact materiality, criteria such as the severity, scope, and irremediable character of negative impacts are considered, while financial materiality is assessed based on potential financial effects, including performance, cash flow, and cost of capital.

- Stakeholder Engagement: One of the critical components of the materiality assessment is engaging with affected stakeholders to understand their perspectives on the company’s impact. This aligns with the broader principles of corporate due diligence under the United Nations Guiding Principles on Business and Human Rights (UNGP) and the OECD Guidelines for Multinational Enterprises.

Interaction Between ESRS 1 Paragraph AR 16 and the Assessment of Material Impacts, Risks, and Opportunities

The relationship between ESRS 1 paragraph AR 16 and the materiality assessment is critical for ensuring that companies comprehensively evaluate all relevant sustainability topics, subtopics, and sub-subtopics as part of their reporting obligations. Paragraph AR 16 of ESRS 1 specifies the sustainability matters that companies must assess for materiality, providing a structured framework that includes environmental, social, and governance (ESG) topics. These matters are grouped into broad categories that cover everything from climate change and biodiversity to human rights and business conduct.

- Topics (e.g., climate change)

- Subtopics (e.g., carbon emissions)

- Sub-subtopics (e.g., scope 1, 2, and 3 emissions)

By following this structure, companies ensure they have not overlooked any relevant material risks, impacts, or opportunities that might arise from their operations or value chain. For instance, a company may start by considering water and marine resources as a sustainability topic, then narrow down the focus to water consumption and water discharges as subtopics before finally identifying material water withdrawal rates as a sub-subtopic. This structured approach ensures that all material aspects of a company’s sustainability profile are thoroughly assessed and reported.

- Impact Materiality: The company evaluates how its operations affect these sustainability matters, determining the extent and severity of any positive or negative impacts on people and the environment. For instance, a company may assess the biodiversity impacts of its raw material extraction processes and determine whether these impacts are significant enough to be classified as material.

- Financial Materiality: The company simultaneously considers how sustainability matters may create financial risks or opportunities. For example, regulatory changes related to carbon emissions could impose significant costs on the company or open up new avenues for investment in low-carbon technologies.

A crucial aspect of ESRS 1 paragraph AR 16 is its requirement for companies to assess material impacts not only within their own operations but also across their upstream and downstream value chains. This ensures that companies account for indirect sustainability risks and impacts. For example, a manufacturing company may need to evaluate the water usage of its suppliers or the carbon footprint associated with the distribution of its products. By extending the materiality assessment to cover the entire value chain, companies gain a holistic view of their sustainability impacts and can identify areas where they may need to adjust their business practices or engage with suppliers and customers.

ESRS 1 emphasizes that impact materiality and financial materiality are often interconnected. The framework under AR 16 highlights that an issue identified as material from an impact perspective can also trigger financial risks or opportunities. For instance, a company facing significant reputational damage due to poor labor practices in its supply chain may experience both a direct negative impact on workers and a financial consequence in the form of reduced investor confidence or increased operational costs due to regulatory penalties.

The illustration below shows the interaction between financial and impact materiality, showing how impacts on people or the environment can influence financial risks and opportunities; underlines that financial risks and opportunities often arise from the company’s material impacts on the environment and society. For instance, failing to address environmental impacts could result in regulatory fines or loss of market share, both of which are financial risks.

Thus, ESRS 1 paragraph AR 16 ensures that companies take a comprehensive, dual-lens approach to their sustainability disclosures. By doing so, companies are able to provide stakeholders—including regulators, investors, and the general public—with a more complete picture of how sustainability matters are integrated into the company’s strategy, operations, and future outlook ( more details could be found in chapter Relationship Between the Materiality Assessment and the Undertaking’s Business Model, Strategy, and Other Decisions)

Impact Materiality: Legal and Practical Considerations

Impact materiality under ESRS requires companies to assess how their operations influence people, the environment, and societal structures. This is assessed using criteria such as:

- Scale and Scope: The severity and breadth of the impact, including how widespread it is (number of individuals or extent of environmental damage).

- Irremediability: Whether the negative impacts can be effectively remedied. Impacts that cannot be fully mitigated or reversed are given greater weight in materiality assessments.

ESRS also provides guidance on setting quantitative and qualitative thresholds for determining the materiality of impacts. These thresholds must be based on objective criteria and supported by evidence wherever possible. However, due to the evolving nature of sustainability reporting, companies are encouraged to use judgment in cases where evidence is inconclusive, particularly in emerging areas of sustainability like biodiversity or human rights impacts.

Financial Materiality: Integration with Traditional Financial Reporting

While impact materiality focuses on the external consequences of corporate activities, financial materiality assesses how these same issues affect the financial position of the company. Under ESRS, companies must disclose sustainability-related risks and opportunities that could influence financial performance. This includes considerations such as:

- Sustainability Risks: For example, exposure to regulatory changes or climate-related physical risks (flooding, extreme weather).

- Sustainability Opportunities: Potential benefits arising from sustainability initiatives, such as increased access to capital due to improved ESG performance or cost savings from energy efficiency measures.

The ESRS guidance aligns closely with International Sustainability Standards Board (ISSB) requirements for financial materiality, ensuring that European companies comply with international standards while addressing EU-specific regulatory demands. This interoperability between ESRS and ISSB is critical for ensuring that European companies remain competitive in global markets.

Reporting Requirements and Legal Implications

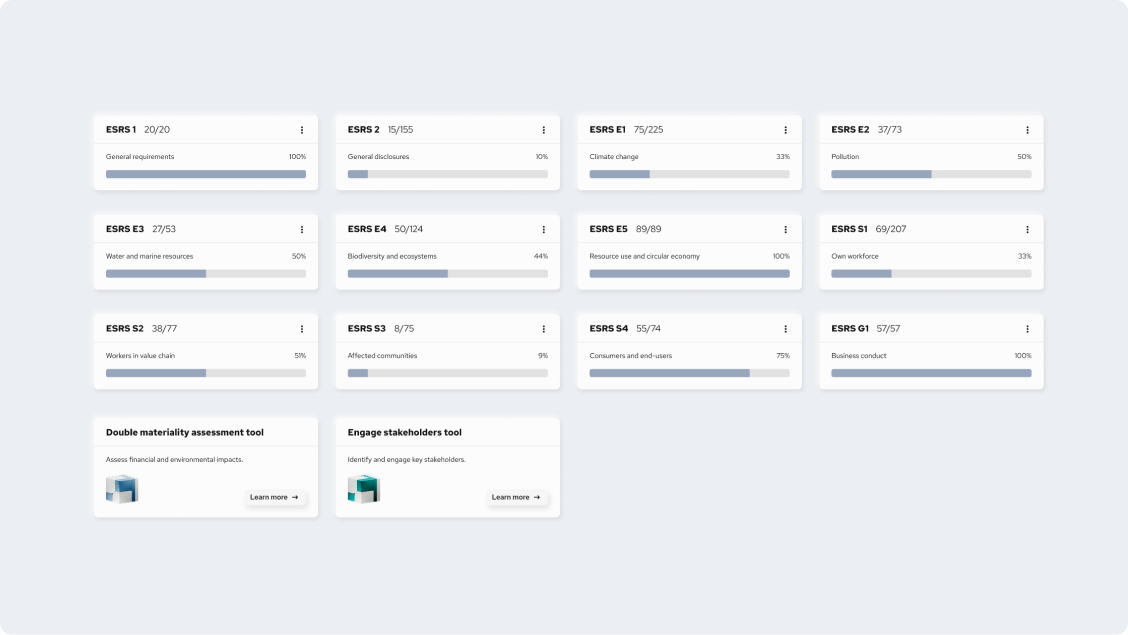

Following the materiality assessment, companies must report the outcomes in their sustainability statement. Under ESRS 2, companies are required to disclose:

- 1. Process Description: A clear explanation of how the materiality assessment was conducted, including methodologies, criteria, and thresholds applied.

- 2. IRO Interaction with Strategy: Disclosure of how material impacts, risks, and opportunities interact with the company’s overall strategy and business model.

- 3. Specific Disclosures: Companies must report on the sustainability matters identified as material, detailing both policies and actions taken to address these issues. Importantly, where no policies exist to manage a material sustainability matter, this must be explicitly stated.

Companies are also required to disclose how their materiality assessments align with internal reporting mechanisms, including financial reports. This consistency is crucial for ensuring that sustainability information is comparable and verifiable across different reporting frameworks.

Relationship Between the Materiality Assessment and the Undertaking’s Business Model, Strategy, and Other Decisions

One of the central tenets of the European Sustainability Reporting Standards (ESRS) is the integration of the materiality assessment with a company’s business model, strategy, and decision-making processes. The materiality assessment is a procedure that informs corporate strategy and decision-making by identifying the sustainability impacts, risks, and opportunities (IROs) that are most critical to the organisation.

Under ESRS 1, the materiality assessment serves as a strategic assessment ( tool) that provides insights into both the positive and negative externalities associated with a company’s operations. This, in turn, directly influences the company’s strategic choices, business model adaptations, and future-oriented decisions. The relationship between the materiality assessment and the business model can be broken down into several key aspects:

- Alignment with Strategic Objectives:

Companies need to align their materiality assessments with their overarching business strategy. This ensures that the identification of material sustainability impacts, risks, and opportunities (IROs) is consistent with the company’s short-term and long-term strategic objectives. For instance, if a company aims to achieve carbon neutrality by 2030, the materiality assessment will focus on identifying both the impacts the company has on the environment and the financial risks associated with carbon regulations. This alignment ensures that sustainability risks and opportunities are fully integrated into strategic planning processes, including financial forecasts, capital allocation, and investment strategies.

- Integration with the Business Model:

The materiality assessment is closely tied to the company’s business model, particularly how it creates value over time. For example, a company with a business model reliant on natural resources must consider both the sustainability of those resources and any associated financial risks. The materiality assessment identifies these dependencies and assesses the company’s reliance on these resources, which, in turn, informs the business model’s sustainability and future viability. The assessment of upstream and downstream value chain impacts—an ESRS requirement—also feeds into the company’s overall value creation strategy, prompting modifications to sourcing, production, and distribution practices to mitigate identified sustainability risks.

- Impact on Strategic Decision-Making:

The materiality assessment helps shape key decisions regarding corporate policies, resource allocation, and governance structures. For instance, if a materiality assessment highlights severe risks related to human rights abuses in the supply chain, this could prompt the company to revise its procurement policies, renegotiate supplier contracts, or implement additional oversight mechanisms. Likewise, identified opportunities, such as demand for sustainable products, can drive decisions to innovate or expand into new markets. By assessing these material impacts, companies can refine their strategies to be both financially sound and sustainable.

- Risk Management and Corporate Governance:

As ESRS explicitly requires companies to report on both the financial and impact materiality perspectives, the materiality assessment results must be integrated into the company’s risk management frameworks. This enhances the company’s ability to identify and mitigate risks associated with sustainability issues, such as regulatory changes, market shifts, or stakeholder pressures. In turn, the findings from the materiality assessment guide corporate governance processes, particularly in how boards and executive leadership teams oversee and manage sustainability risks.

Sector-Specific and Entity-Specific Considerations

While the ESRS provides a general framework for materiality assessments, it recognizes that sector-specific factors may influence materiality. For instance, a chemical manufacturing company may have different material sustainability risks compared to a financial institution. As sector-specific standards are still under development, companies are encouraged to utilize established frameworks such as the Global Reporting Initiative (GRI) or Sustainability Accounting Standards Board (SASB) to fill gaps in ESRS disclosures.

The Role of Stakeholder Engagement in Materiality Assessments

Effective stakeholder engagement is at the heart of the impact materiality process. Companies are expected to consult with both affected stakeholders (e.g., local communities, employees) and users of sustainability reports (e.g., investors, regulators) to ensure that their materiality assessments reflect a broad range of perspectives. This engagement helps substantiate the materiality of identified impacts and ensures that sustainability reporting is aligned with stakeholder expectations.

Conclusion: Navigating Double Materiality in Practice

Double materiality represents a comprehensive and complex approach to sustainability reporting, necessitating a detailed understanding of both financial and non-financial impacts. For undertakings mastering the intricacies of double materiality is critical to ensuring compliance with CSRD and ESRS while enhancing corporate transparency and accountability. The interplay between financial and impact materiality highlights the evolving role of corporations in addressing sustainability issues, with far-reaching implications for corporate governance and stakeholder engagement.

All sustainability matters affected by or thet have an effect on the undertaking.