The Sustainable Finance Disclosure Regulation

Table of contents

Jump to section

Introduction

The Sustainable Finance Disclosure Regulation (SFDR), introduced by the European Union in December 2019 under Regulation (EU) 2019/2088, seeks to enhance transparency in the financial sector by requiring financial market participants and advisers to disclose detailed information on sustainability practices. This regulation mandates that these entities provide investors with insights into how sustainability risks, which can impact the value and returns of investments (‘outside-in’ effect), are considered. Additionally, it requires disclosure of the adverse effects that investments may have on the environment and society (‘inside-out’ effect). Such information must be made available not only for specific financial products but also at the firm level, and should be accessible via company websites, pre-contractual product documents, and annual reports. The SFDR establishes rules that require financial market participants to substantiate any sustainability claims associated with their financial products. These regulations apply to various entities managing assets on behalf of investors, including asset managers, insurance companies, pension providers, and investment firms.

Policy making timeline

Scope and Applicability of the SFDR

Entities Covered by the SFDR

The SFDR applies to a broad spectrum of financial market participants, including asset managers, insurance companies, pension providers, and investment firms. Financial advisers are also subject to the regulation, ensuring that all entities involved in the provision and management of financial products are aligned with the EU’s sustainability objectives. Notably, the SFDR distinguishes between different types of financial products, categorizing them under Articles 6, 8, and 9, each with varying levels of disclosure requirements depending on their sustainability characteristics.

Geographical Scope and Extra-Territorial Impact

While the SFDR primarily targets EU-based entities, its scope extends to non-EU entities that market financial products within the EU. This extra-territorial application ensures that all products available to EU investors adhere to the same transparency and sustainability standards, thereby fostering a level playing field across global financial markets.

Interaction with Other EU Regulations

The SFDR is not an isolated regulation; it operates within a complex web of EU legislation aimed at fostering sustainability. It closely interacts with the EU Taxonomy Regulation, which provides a classification system for sustainable economic activities, and the Non-Financial Reporting Directive (NFRD), which mandates sustainability reporting for large companies. With the upcoming Corporate Sustainability Reporting Directive (CSRD) set to replace the NFRD, financial market participants must navigate these overlapping obligations carefully, ensuring comprehensive compliance across all regulatory frameworks.

Disclosure Requirements under the SFDR

Pre-Contractual Disclosures

One of the SFDR’s key components is the requirement for financial market participants to provide detailed pre-contractual disclosures. These disclosures must include information on how sustainability risks are integrated into investment decisions and the principal adverse impacts (PAIs) of these decisions on sustainability factors. The level of detail required varies depending on the product classification—Article 6 products have basic disclosure requirements, while Article 8 and 9 products, which promote environmental or social characteristics or have a sustainable investment objective, are subject to more stringent obligations.

Website Disclosures

To ensure ongoing transparency, the SFDR mandates that financial market participants publicly disclose sustainability-related information on their websites. This includes the entity’s policy on integrating sustainability risks, details on how PAIs are considered, and information on how these factors influence remuneration policies. These disclosures are intended to provide investors with easy access to relevant information, supporting informed investment decisions.

Periodic Reporting Obligations

In addition to pre-contractual and website disclosures, the SFDR requires periodic reporting on the sustainability performance of financial products. For Article 8 and 9 products, these reports must demonstrate how the products’ environmental or social characteristics or sustainable investment objectives have been achieved. This ongoing reporting obligation ensures that financial products remain aligned with their stated sustainability goals throughout their lifecycle.

Regulatory Technical Standards (RTS) and Amendments

Commission Delegated Regulation (EU) 2022/1288

To standardize the format and content of sustainability disclosures, the European Commission adopted Regulatory Technical Standards (RTS) under Delegated Regulation (EU) 2022/1288. These RTS provide detailed guidance on the methodologies for calculating sustainability metrics and assessing PAIs, ensuring that disclosures are comparable across different financial products and entities.

Amendments via Commission Delegated Regulation (EU) 2023/363

Further refinements to the SFDR were introduced through Commission Delegated Regulation (EU) 2023/363, which became effective on 20 February 2023. These amendments specifically address the disclosure of financial products’ exposure to gas and nuclear-related activities, aligning with the EU Taxonomy and the Complementary Climate Delegated Act (CDA). By including these sectors under the disclosure requirements, the regulation ensures that investors are fully informed about the environmental impacts of their investments.

Principal Adverse Impacts (PAI) Statement

Overview

The PAI Statement is a disclosure requirement under the SFDR that mandates financial market participants to assess and report the negative impacts of their investment decisions on environmental, social, and governance (ESG) factors. These impacts, known as Principal Adverse Impacts, can include a wide range of issues, such as carbon emissions, biodiversity loss, water usage, and violations of human rights.

The purpose of the PAI Statement is to ensure that investors are fully informed about the potential adverse effects of their investments, enabling them to make more responsible and sustainable choices. By providing this information, financial market participants can demonstrate their commitment to sustainability and align with the EU’s broader goals of promoting sustainable finance.

Key Components

The PAI Statement is structured around a set of indicators that financial market participants must assess and disclose. These indicators are categorized into environmental, social, and governance factors, providing a comprehensive view of the potential adverse impacts of investments. The Regulatory Technical Standards (RTS) introduced under Commission Delegated Regulation (EU) 2022/1288 provide detailed guidance on the specific indicators to be used and the methodology for calculating them.

1. Environmental Indicators:

- Greenhouse Gas Emissions: Disclosure of direct and indirect carbon emissions associated with investment portfolios.

- Biodiversity: Assessment of the impact on biodiversity, including land use and habitat destruction.

- Water Usage: Reporting on water consumption and its effect on local water resources.

2. Social Indicators:

- Human Rights Violations: Evaluation of investments in companies involved in human rights abuses or unethical labor practices.

- Community Impact: Analysis of the effects of investments on local communities, including displacement and social disruption.

3. Governance Indicators:

- Corruption and Bribery: Disclosure of exposure to companies involved in corruption or bribery.

- Board Diversity: Assessment of the diversity and inclusivity of company boards within the investment portfolio.

Key components of PAI statement

Quantitative Disclosure

- 18 mandatory indicators

- 46 optional indicators (report on at least one social and one environmental KPI needs to be reported from the optional indicators)

- Applicable to investee companies, real estate assets, sovereigns and supranationals

Qualitative Disclosure

- Summary on the PAI impact

- Explanation, actions taken and plans

- Include policies to assess PAIs

- Description of actions to address PAIs

- Describe engagement policies

- References to international standards

- Historical comparison

Division of SFDR Indicators (Mandatory)

Climate & Environment

(1 Water, 1 Waste, 1 Biodiversity, 6 GHG emissions)

Sovereigns & Supranationals

(1 Social & 1 Environmental)

Social

(5 social & employee matters)

Real Estate

(1 fossil fuels & 1 energy efficiency)

Key deliverables

The SFDR outlines specific deliverables for financial products, categorized under different articles of the regulation. These deliverables are crucial for ensuring transparency and consistency across all product offerings.

Pre-contractual Disclosure:

- Article 6 – Non-ESG Funds: Products that do not specifically target ESG objectives but still need to disclose how they consider sustainability risks.

- Article 7 – Consideration of PAIs: Products must disclose how they consider Principal Adverse Impacts (PAIs) in their investment decisions or explain why they do not.

- Article 8 – Light Green Funds: Products promoting environmental or social characteristics need to disclose these characteristics and how they are measured and monitored.

- Article 9 – Dark Green Funds: Products with sustainable investment objectives must disclose these objectives and the methodologies used to assess their achievement.

Website Disclosure:

- Article 10 – Describe Sustainability Characteristics: Entities must provide detailed descriptions of the sustainability characteristics of their products on their websites.

Periodic Disclosure:

- Article 11 – Annual Reports for Article 8 & 9 Funds: Periodic reports must be provided to demonstrate how the sustainability characteristics or objectives have been met.

Special Disclosures:

- Comparison with Designated Index: For products promoting environmental or social characteristics, entities must explain how these characteristics compare with designated benchmarks.

- Taxonomy Disclosures: Entities need to explain which environmental characteristics the product promotes or which environmental objectives it targets, and to what extent the investments align with activities considered “environmentally sustainable” under the Taxonomy Regulation.

Example SFDR Fund Classifications: A Decision Tree Approach

The SFDR also requires financial products to be classified under specific categories—Article 6, Article 8, or Article 9—based on their sustainability objectives. This classification is essential for determining the level of disclosure required.

Criteria on Fund Classifications:

- Article 6 Funds: These funds may or may not integrate sustainability risks into their investment processes, but they do not meet the criteria established for Article 8 or Article 9 funds. They typically integrate sustainability risks without actively promoting ESG factors or adhering to strict sustainability criteria.

- Article 8 Funds (Light Green Funds): These funds promote environmental or social characteristics and ensure that the companies in which they invest follow good governance practices. However, sustainability is not the primary objective of these funds.

- Article 9 Funds (Dark Green Funds): These funds have sustainable investment as their core objective, meaning they aim to contribute positively to environmental or social objectives through their investments.

SFDR Classification Decision Tree:

- Step 1: Determine whether the product integrates sustainability risks. If not, it is classified under Article 6.

- Step 2: If the product does integrate sustainability risks, assess whether it has a sustainable investment objective. If it does, classify it under Article 9.

- Step 3: If the product promotes environmental or social characteristics but does not have a sustainable investment objective, classify it under Article 8.

This decision tree provides a structured approach for financial market participants to determine the appropriate classification for their products, ensuring compliance with the SFDR and transparency for investors.

Criteria on fund classifications

- Article 6 fund may or may not integrate sustainability risk but do not meet criteria of Article 8 & 9.

- Article 8 fund promotes E/S characteristics and follow good governance practices.

- Article 9 fund has sustainable investment as its objectives.

Product

Any product distributed in the EU (fund, mandate, etc.)

Article 6 question

Does it integrate sustainability risks?

Article 9 question

Does it have a sustainable investment objective?

Article 8 question

Does it promote environmental or social characteristics?

No

Yes

Yes

No

Yes

No

Article 6

Does not integrate sustainability risks

No ESG Integration in

the product

Article 9

Integrates sustainability risks

+ has sustainable investment objective

Any product that invests in economic activities that contribute to one or more environmental or social objectives

Article 8

Integrates sustainability risks + promotes environmental or social characteristics

Any product that has:

- binding portfolio-level ESG KPIs

- or advanced fund-level exclusions

- or a sustainable level

- or a clear sustainable theme

Article 6

Integrates sustainability risks

(no ESG promotion)

ESG integration without meeting binding criteria (lack of coverage, etc)

Product

Any product distributed in the EU (fund, mandate, etc.)

Article 6 question

Does it integrate sustainability risks?

No

Yes

Article 6

Does not integrate sustainability risks

No ESG Integration in

the product

Article 9 question

Does it have a sustainable investment objective?

No

Yes

Article 9

Integrates sustainability risks

+ has sustainable investment objective

Any product that invests in economic activities that contribute to one or more environmental or social objectives

Article 8 question

Does it promote environmental or social characteristics?

No

Yes

Article 8

Integrates sustainability risks + promotes environmental or social characteristics

Any product that has:

- binding portfolio-level ESG KPIs

- or advanced fund-level exclusions

- or a sustainable level

- or a clear sustainable theme

Article 6

Integrates sustainability risks

(no ESG promotion)

ESG integration without meeting binding criteria (lack of coverage, etc)

The are specific data requirements needed to comply with the disclosure obligations for Article 8 and Article 9 funds. These funds are distinguished by their focus on promoting environmental or social characteristics (Article 8) or having sustainable investment as their core objective (Article 9). To ensure compliance, these funds must gather and disclose both qualitative and quantitative data that support their sustainability claims.

Qualitative Data Requirements

1. EU Taxonomy-Alignment Data (Turnover, CapEx, OpEx):

Funds must provide data demonstrating the alignment of their investments with the EU Taxonomy, which defines what constitutes a sustainable economic activity. This includes key financial indicators such as turnover, capital expenditures (CapEx), and operational expenditures (OpEx).

2. PAIs to Support DNSH (Do No Significant Harm):

Principal Adverse Impacts (PAIs) must be disclosed to demonstrate that the investments do not significantly harm any environmental or social objectives, in line with the DNSH principle.

3. Governance Data:

Detailed governance data is required to show that the investee companies follow good governance practices, including sound management structures, employee relations, and compliance with tax obligations.

4. OECD and UNGC Compliance Data:

Compliance with international standards, such as those set by the OECD and the United Nations Global Compact (UNGC), must be documented and disclosed.

5. Benchmark Data for Comparison:

Benchmark data must be provided to compare the performance of the fund against relevant benchmarks, ensuring that the sustainability objectives are being met effectively.

Quantitative Data Requirements

1. Sustainability Indicators:

Products must identify and disclose the sustainability indicators used to measure the attainment of the environmental or social characteristics promoted, or the sustainable investment objective.

2. Investment Strategy Implementation:

Funds need to explain how the strategy is implemented in the investment process on a continuous basis, ensuring transparency in how sustainability objectives are pursued.

3. Good Governance Practices:

A statement of the policy used to assess good governance practices at the investee companies is required, underscoring the importance of governance in sustainable investing.

4. Asset Allocation:

Disclosure of the planned asset allocation is essential, detailing how investments are aligned with the promoted environmental or social characteristics. Article 9 funds must also explain how the use of certain assets does not negatively impact the sustainable investment objective.

5. Derivatives:

Funds must disclose how derivatives are used, if at all, to achieve the environmental or social characteristics or the sustainable investment objective.

6. Sustainable Investments:

An explanation is required on how the investments contribute to sustainable objectives without causing significant harm to any sustainability goal.

5. Principal Adverse Impacts (PAIs):

Funds must disclose how their investments affect sustainability factors, ensuring that any negative impacts are transparently reported.

5. Benchmarks:

If a designated reference benchmark is used, funds must explain how it aligns with the environmental or social characteristics promoted and how it differs from a broad market index.

Qualitative data

- EU Taxonomy-alignment data (Turnover, CapEx, OpEx)

- PAIs to support DNSH

- Governance data

- OECD and UNGC compliance data

- Benchmark data for comparison

Quantitative data

- Sustainability indicators

- Investment strategy

- Asset allocation

Data Aggregation in SFDR: A Closer Look

In the context of the Sustainable Finance Disclosure Regulation (SFDR), data aggregation at the entity level is a crucial process for accurately reporting sustainability metrics. This process involves compiling and averaging data from various investments to ensure that disclosures reflect the true impact of the entire portfolio. Lets have a look on how data aggregation works, both on a quarterly and annual basis.

Step 1: Aggregating Data Quarterly

The first step in the data aggregation process involves compiling data on a quarterly basis. All investments, whether direct or indirect, are included in this aggregation. The data is then calculated as an arithmetic average of four calculations, which are taken on the last day of each quarter.

- Inclusion of All Investments: The aggregation process includes all types of investments within the portfolio, ensuring a comprehensive overview. This encompasses both direct investments in companies and indirect investments through other financial instruments.

- Arithmetic and Weighted Averages: For each quarter, the values are averaged using arithmetic means. Additionally, weighted averages are calculated to reflect the relative size of each investment within the portfolio. This weighted approach allows for a more accurate representation of the portfolio’s overall impact, considering the significance of larger investments.

For example, in the provided table, we see different companies (Company 1, Company 2, etc.) with their respective funds (Fund A, Fund B) and quarters (Q1). The data columns include the current value of investment, EVIC (Economic Value to Invested Capital), emissions to water, and calculated weighted averages. These are then summed up to provide an aggregate figure for the quarter.

Step 2: Aggregating Data Annually

After quarterly data is aggregated, the next step is to compile these results annually. This involves averaging the quarterly data to obtain annual metrics that provide a broader view of the investment portfolio’s performance over the year.

- Annual Aggregation: The data is aggregated annually by taking the weighted averages from each quarter and combining them to get a total for the year. This step includes calculating the average per quarter and then multiplying by the current value of investments to get a weighted average per million euros invested.

- Weighted Average Per Million Euro Invested: A critical metric in the annual aggregation is the weighted average per million euros invested, which normalizes the data across different investment sizes. This allows for more straightforward comparisons between different periods or portfolios.

The visual shows how data from each quarter is compiled, showing the weighted average per quarter, current value of investments, and weighted average per million euros invested. These are then summed to provide an annual aggregate, which offers a clear snapshot of the sustainability performance of the portfolio over the year.

Importance of Accurate Data Aggregation

Accurate data aggregation is essential for complying with SFDR reporting requirements, particularly for Principal Adverse Impact (PAI) disclosures. By ensuring that all investments are accounted for and that averages reflect the portfolio’s true impact, financial market participants can provide more reliable and transparent disclosures to investors. This level of detail helps investors make informed decisions, aligning their investments with their sustainability goals.

Data Aggregation at the entity level

- All investments included (direct investments vs indirect investments)

- An arithmetic average of four calculations on the the last day of each quarter

- Weighted average, weighted average per million Euro vs Average

| Company | Fund | Q | Current value of investment | EVIC | Emissions to water | Weighted average | Weighted average per quarter |

|---|---|---|---|---|---|---|---|

| Company 1 | Fund A | Q1 | 2 | 1268 | 50 | 0,16% | 0.08 |

| Company 2 | Fund A | Q1 | 5 | 4224 | 125 | 0,10% | 0.13 |

| Company 3 | Fund B | Q1 | 5 | 5338 | 15 | 1,09% | 0.01 |

| Company 4 | Fund B | Q1 | 0 | 690 | 0 | 0,00% | 0.00 |

| Total | 0.22 |

Step 2: Aggregate data annually

| Quarter | Weighted average per quarter | Quarter | Current value of investment | Weighted average per million euro invested |

|---|---|---|---|---|

| Q1 | 0.22 | 0.06 | 12.00 | 0.005 |

| Q2 | 0.52 | 0.13 | 12.00 | 0.006 |

| Q3 | 0.66 | 0.17 | 27.00 | 0.006 |

| Q4 | 0.53 | 0.13 | 28.00 | 0.005 |

| Total | 0.48 | 0.022 |

SFDR revision & product reclassification framework

The European Commission proposal of 20 November 2025 (COM(2025) 841 final) introduces a

fundamental restructuring of the Sustainable Finance Disclosure Regulation (SFDR).

The revised framework transforms SFDR from a disclosure regime centred on Articles 6, 8 and 9 into

a formal product categorisation system, supported by legally defined thresholds, exclusions,

disclosure requirements, naming rules, and supervisory safeguards.

This section provides a comprehensive technical explanation of all material changes introduced by

the SFDR review.

1. Scope and subject matter

The scope of SFDR is materially narrowed and clarified.

SFDR now applies exclusively to financial market participants that manufacture, manage, or

make available financial products. The Regulation is explicitly refocused on product-level

sustainability claims.

As a result:

- Financial advisers providing investment advice only, and

- Portfolio management services based on discretionary, client-by-client mandates

are explicitly excluded from scope (amended Articles 1, 2, 3 and 6).

| Aspect | SFDR I (current) | SFDR review |

|---|---|---|

| Core focus | Entity + product disclosures | Product-level only |

| Financial advisers | In scope | Out of scope |

| Portfolio management | In scope | Out of scope |

| Sustainability claims | Broad | Product-specific |

SFDR is therefore repositioned as a product-centric regulatory framework, no longer an entity-level

sustainability reporting regime.

This redesign:

- removes duplication with MiFID II and IDD distributor obligations;

- aligns SFDR with the CSRD for entity-level sustainability reporting;

- anchors sustainability claims exclusively to financial products that are designed, structured, and

- marketed.

- New Article 17 introduces optional exemptions for specific closed-ended financial products created before the application date of the revised Regulation.

- The categorisation regime is without prejudice to national sustainability labels, provided those schemes impose additional requirements beyond SFDR.

Prohibition of national gold-plating

To safeguard the integrity of the internal market, amended Article 14 explicitly prevents Member States from introducing additional national disclosure or categorisation requirements for sustainability-related financial products.

This ensures full harmonisation of SFDR categories, disclosures, and naming rules across the EU.

2. Definitions

The SFDR review introduces a systematic overhaul of definitions to address long-standing implementation issues.

- Definitions related to financial advisers and portfolio management services are deleted.

- The definition of “sustainable investment” (Article 2(17) SFDR I) is removed in its entirety.

The removal of Article 2(17) addresses legal uncertainty, divergent supervisory interpretations, and misuse of the concept as a de facto product label.

| Definition | Status |

|---|---|

| Financial adviser | ❌ Removed |

| Portfolio management | ❌ Removed |

| “Sustainable investment” (Art. 2(17) SFDR I) | ❌ Deleted |

New categorisation-based definitions

The revised framework replaces the “sustainable investment” concept with a category-based architecture, centred on:

- “Sustainability-related financial products”, meaning products falling under Articles 7, 8 or 9; and

- “Sustainability-related financial product with impact” (new Article 2(26)), applicable where measurable sustainability impact is explicitly claimed.

A definition of environmental objectives is introduced, aligned with Article 9 of the EU Taxonomy

Regulation.

Continuity of DNSH and governance concepts

While the standalone definition of “sustainable investment” is deleted, the underlying concepts of:

- contribution to environmental or social objectives,

- avoidance of significant harm, and

- good governance practices

are retained and operationalised within the eligibility criteria, exclusions, and disclosure obligations of the relevant SFDR categories.

Single definition (“sustainable investment”)

Product categories + thresholds + exclusions

3. Categorisation of financial products

The revised SFDR establishes three mutually exclusive product categories, each governed by:

- a minimum quantitative threshold,

- mandatory exclusions, and

- defined disclosure and indicator requirements.

The categorisation system explicitly builds on, and ensures continuity with, the ESMA Guidelines on funds’ names using ESG or sustainability-related terms, while replacing Articles 8 and 9 as informal market labels with legally enforceable categories.

| Category | Article | Core claim |

|---|---|---|

| Non-categorised | 6 / 6a | No sustainability claim |

| ESG basics | 8 | ESG integration beyond risk |

| Transition | 7 | Contribution to transition |

| Sustainable | 9 | Contribution to sustainability |

| Sustainable with impact | 9 + 2(26) | Measurable impact |

| Products combining products | 9a | Exposure to categorised products |

The 70% threshold (common rule)

All categorised products must demonstrate that at least 70% of investments are aligned with the sustainability-related claim made by the product.

A phase-in period may be disclosed, particularly for alternative or private assets.

The threshold must be met no later than the end of the disclosed phase-in period, and interim allocations must not contradict the sustainability-related claim.

3.A. Transition products (new Article 7)

Transition products support or contribute to the environmental or social transition of undertakings,

economic activities, or assets.

Investment requirement

At least 70% of investments must:

- support the transition of undertakings, activities, or assets towards sustainability; or

- contribute directly to defined transition objectives.

Eligible transition approaches

The Regulation adopts a principles-based, open list of approaches, including:

- alignment with EU Climate Transition Benchmarks (CTB) or EU Paris-Aligned Benchmarks (PAB);

- investment strategies based on credible transition plans or science-based targets;

- portfolio-level transition metrics (e.g. financed emissions trajectories);

- capital allocation to transitional economic activities or capex aligned with future sustainability improvements.

Exclusions

Mandatory exclusions apply, aligned with:

- CTB exclusions (controversial weapons, tobacco, breaches of international norms); and

- additional restrictions on fossil-fuel expansion activities.

Safe harbour

Automatic compliance applies where:

- the product tracks or references a CTB or PAB; or

- at least 15% of assets are EU Taxonomy-aligned, subject to exclusions.

3.B. ESG basics products (new Article 8)

ESG basics products integrate sustainability factors beyond sustainability risk management, without

claiming transition or sustainability objectives.

Investment requirement

At least 70% of investments must integrate sustainability factors in a systematic and demonstrable

manner.

Integration approach

Integration approaches are principles-based and may include ESG screening, weighting, stewardship,

or scoring.

Integration must be measurable through sustainability-related indicators.

Exclusions and safe harbour

- Mandatory exclusions are limited to CTB-type exclusions.

- No safe harbour mechanism applies.

3.C. Sustainable products (new Article 9)

Sustainable products invest in, or contribute to, environmental or social sustainability objectives.

At least 70% of investments must:

- invest in sustainable undertakings, activities, or assets; or

- contribute to sustainability objectives.

Exclusions and safe harbour

- Stricter exclusions apply, aligned with PAB requirements.

- Automatic compliance applies where:

- the product tracks or references a PAB; or

- at least 15% of assets are EU Taxonomy-aligned, subject to exclusions.

Impact sub-classification

Where a sustainable product claims measurable sustainability impact, it must qualify as a

sustainability-related financial product with impact and comply with additional KPI and reporting

obligations.

4. Debt instruments and sovereign exposures (Recital 22)

Use-of-proceeds instruments

- May be included in the 70% bucket if proceeds do not fund excluded activities.

- European Green Bonds automatically comply.

Issuer-level exclusions

Certain exclusions apply irrespective of use-of-proceeds, including breaches of international norms

and fossil-fuel expansion activities (for transition and sustainable categories).

Sovereign debt

- Verified sovereign use-of-proceeds debt may qualify across all categories.

- General-purpose sovereign debt:

- excluded from transition and sustainable categories;

- eligible for ESG basics only where sustainability integration is demonstrated.

5. Products combining other financial products (new Article 9a)

Products investing in other financial products are subject to a dedicated regime.

- A product may claim a category only if ≥70% of assets are invested in categorised products or

- equivalent qualifying assets.

- Where the threshold is not met, the product:

- cannot claim a category;

- may only disclose exposure to categorised products;

- must provide detailed pre-contractual transparency on composition and residual investments.

6. Product-level disclosures

General requirement

All products must disclose how sustainability risks are integrated (revised Article 6).

Non-categorised products (new Article 6a)

- May reference sustainability factors only in a non-prominent, ancillary manner.

- May not make sustainability or ESG claims in names or marketing communications.

Mandatory disclosures for categorised products

Categorised products must disclose:

- confirmation of category compliance;

- sustainability-related objectives or factors;

- investment strategy, qualifying investments, and phase-in period;

- indicators used to measure progress;

- mandatory and voluntary exclusions;

- data sources and methodologies.

Additional obligations for transition and sustainable products

- Identification and disclosure of the principal adverse impacts of investments, and actions

- taken or planned to address those impacts;

- disclosure of EU Taxonomy alignment where environmental objectives are pursued;

- for impact products: impact KPIs, measurement, management, and reporting methodologies.

Indicator framework

Indicators must build, where appropriate, on:

- indicators previously used under Commission Delegated Regulation (EU) 2022/1288;

- relevant ESRS data points disclosed under the CSRD;

- other robust and commonly used sustainability metrics.

Publication channels

Pre-contractual, periodic (Article 11), and website disclosures (Article 10) are mandatory.

7. Marketing communications and naming

The revised SFDR introduces binding controls on naming and marketing.

- ESG or sustainability claims are permitted only for categorised products.

- Impact claims require qualification as a sustainability-related financial product with impact.

- Products under Article 9a may not use ESG terms in their names.

- Non-categorised products may not use ESG or sustainability claims at all

Sustainability-related claims under SFDR are aligned with the Unfair Commercial Practices Directive, ensuring claims are clear, fair, and not misleading.

8. Use of data and estimates (new Article 12a)

Sustainability information must be based on:

- documented arrangements with data providers; or

- robust, transparent, and reproducible methodologies.

Where ESG ratings are used in marketing, methodologies and sources must be disclosed on the website.

9. Entity-level disclosures

Entity-level obligations are significantly reduced:

- Retained: disclosure on sustainability risk integration (Article 3).

- Removed:

- entity-level PAI statements (Article 4 SFDR I);

- remuneration policy disclosures (Article 5 SFDR I).

Consequential amendments ensure consistency with the European Single Access Point (ESAP).

10. Technical standards and delegated acts (Level 2)

- Commission Delegated Regulation (EU) 2022/1288 is repealed.

- The Commission is empowered under Article 19b to adopt delegated acts specifying:

- indicators for the 70% threshold;

- exclusions and limited hedging exceptions;

- calculation methodologies and phase-in rules;

- disclosure templates and page limits.

Category names are fixed in Level 1 and will not be redefined via RTS.

Transitional provisions

Specific transitional provisions apply to certain insurance-based and pension products not previously covered by ESMA fund name guidelines, ensuring orderly transition.

11. Interaction with other EU legislation

Targeted amendments to the PRIIPs Key Information Document (KID) require disclosure of:

- the SFDR category;

- the sustainability objective;

- the key indicators used to measure it.

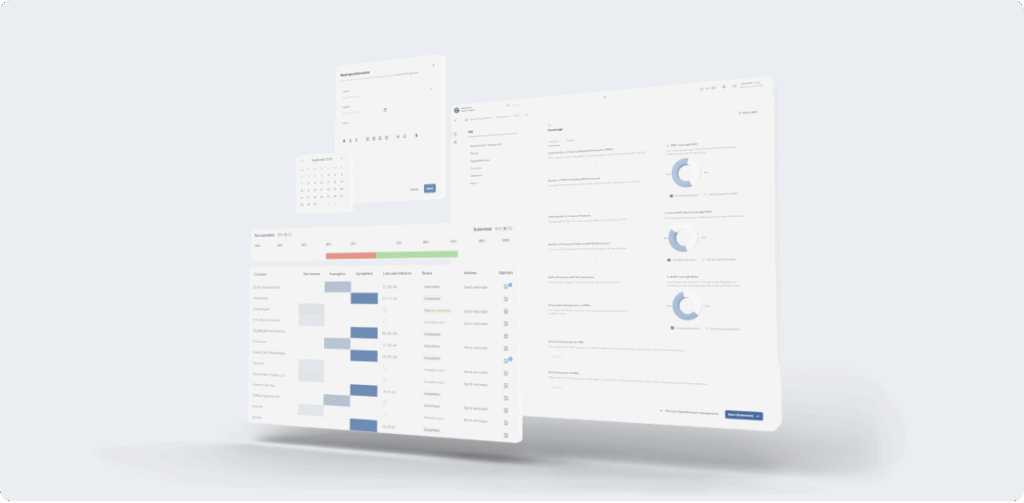

How Generation Impact Global supports SFDR compliance

Generation Impact Global provides a regulatory-grade SFDR compliance platform designed to operationalise the revised SFDR framework, including product categorisation, disclosures, naming controls, and ongoing monitoring.

The platform is built to support Article 6 / 6a, Articles 7, 8, 9 and 9a products, as redefined under the SFDR review.