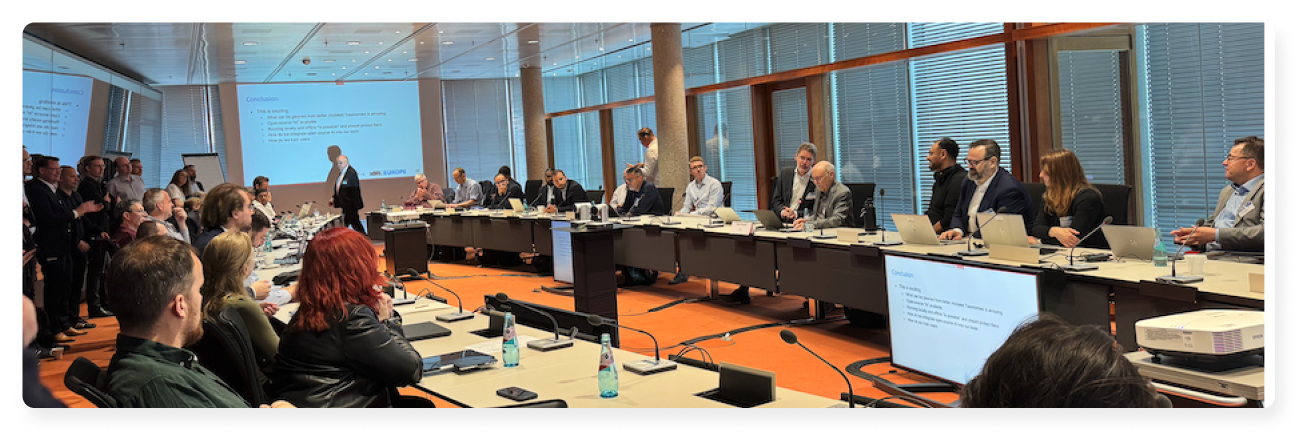

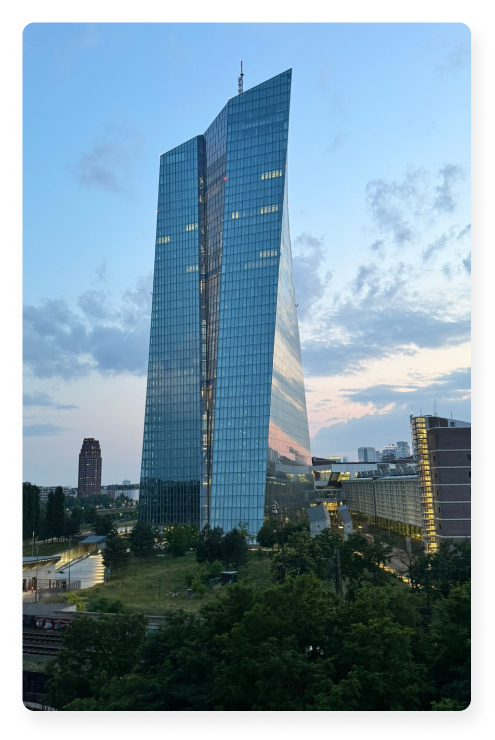

Frankfurt, 3 June 2025 — For three days, under the skyline of Europe’s financial capital, industry leaders, regulatory bodies, and data pioneers came together for Digital Reporting in Europe 2025, hosted by the European Central Bank. But this wasn’t just another annual summit—it felt like a turning point.

The conference touched on everything from AI-enhanced data analysis to cross-border digital identities, and from sustainability standards to open-source tooling. In other words, the future of digital reporting wasn’t being discussed—it was being built.

Day 1: From complexity to clarity

The first day launched with a focus on simplifying the increasingly tangled web of regulatory reporting.

The shift wasn’t about adding more layers—it was about removing friction and making the system smarter.

Simplifying with the European Banking Authority

The European Banking Authority (EBA) laid out its refreshed approach to regulatory data collection. Their message was direct: better systems, not just more rules. With updated data models, revamped validation rules, and the development of the Pillar 3 Data Hub, the EBA made clear that open access to meaningful, comparable information is no longer a luxury—it’s a requirement.

The bigger shift? ESG data is no longer sitting on the sidelines. It’s being pulled into the center of financial reporting conversations.

Sustainability in XBRL: a new era for GRI

The Global Reporting Initiative (GRI) unveiled its Sustainability Taxonomy—a move that transforms ESG disclosures into structured, machine-readable information. Built for interoperability, the taxonomy is designed to work easier with frameworks like ISSB and ESRS, easing the reporting burden for global organizations.

The technical work behind this launch speaks to a broader shift: ESG is becoming data. And that data needs to be consistent, comparable, and ready to inform decisions.

The ERICA Mapper: bridging ESEF and economic analysis

The ERICA Working Group, supported by XBRL Spain and the Eurofiling Foundation, introduced a tool that may not have flashy branding—but it works. The ERICA Mapper converts ESEF filings into formats used by national banks, making regulatory filings useful for policy analysis and macroeconomic research.

Even better? It’s open-source and Excel-friendly, proving that accessibility and innovation can go hand-in-hand.

Open Standards and Metadata: the unsung heroes

Meaningful Data presented a compelling case for smarter metadata. Standards like LEI, SDMX, and VTL aren’t just acronyms—they’re the backbone of systems that scale. When metadata is structured well, validation becomes easier, cross-referencing becomes seamless, and reporting becomes future-ready.

Our Contribution: Making SFDR more than just a checklist

Our team took the stage to address a challenge many financial institutions still face: how to report under the Sustainable Finance Disclosure Regulation (SFDR) without getting buried in spreadsheets.

We presented a practical digital workflow of SFDR disclosures. By automating tagging, aligning with EU taxonomies, and applying built-in validation logic, we demonstrated how reporting can be made faster, more accurate, and more useful—for both filers and regulators.

The goal? To turn sustainability reporting into a strategic function, not just a compliance task

Day 2: Identity, Intelligence, and Interoperability

The second day brought new dimensions to the table—especially in the areas of trust, automation, and global coordination. If day one asked how, day two asked what’s next?

GLEIF’s digital identity for the real world

The Global Legal Entity Identifier Foundation (GLEIF) introduced its next-generation solution: the verifiable LEI (vLEI). This digital identity doesn’t just identify companies; it verifies people authorised to act on their behalf.

This opens up possibilities across the board—from simplifying onboarding in finance to validating ESG credentials or streamlining cross-border trade.

AI meets reporting: no longer Sci-Fi

The Federal Financial Supervisory Authority (BaFin) painted a scenario that’s closer than many think: analysts working side-by-side with AI tools that summarize reports, flag inconsistencies, and explain results in plain language.

It’s not about handing off responsibility to algorithms—it’s about extending the reach of human expertise.

Meanwhile, Exbee Ltd. gave a closer look at how AI models like FinGPT and FinRobot are already parsing financial data, thanks to advances like the Open Information Model (OIM). This new format makes traditional XBRL data far easier for machines to process—and for humans to interpret.

ISSB’s progress on Global Sustainability Standards

The International Sustainability Standards Board (ISSB) shared updates on the growing adoption of IFRS S1 and S2. More than just technical standards, these frameworks aim to create a common language for sustainability reporting, one that can work across borders.

With active coordination among GRI, SASB, and the European Commission, the message was clear: fragmentation is giving way to alignment.

DPM Studio: a behind-the-scenes revolution

The European Banking Authority also gave a closer look at DPM Studio, a tool that allows regulators to build and update their reporting frameworks with less friction. For many, it was the kind of quiet infrastructure update that has huge implications over time—making taxonomy management faster, more modular, and more transparent.

Looking ahead: building on shared ground

As the event drew to a close, one theme stood out: the future of reporting isn’t about adding more—it’s about connecting better. Whether it’s ESG, AI, or global frameworks, the momentum is shifting toward systems that talk to each other and serve real-world needs.

We left Frankfurt inspired. Not only by the technologies on display, but by the clarity of vision shared across sectors. This wasn’t about speculation or pilot projects—it was about real tools, real frameworks, and real progress.

A big thank-you to the European Central Bank, the Eurofiling Foundation, and all the organizations that made the event a success. We’re already putting what we learned into practice—and we’re excited to see what’s next.