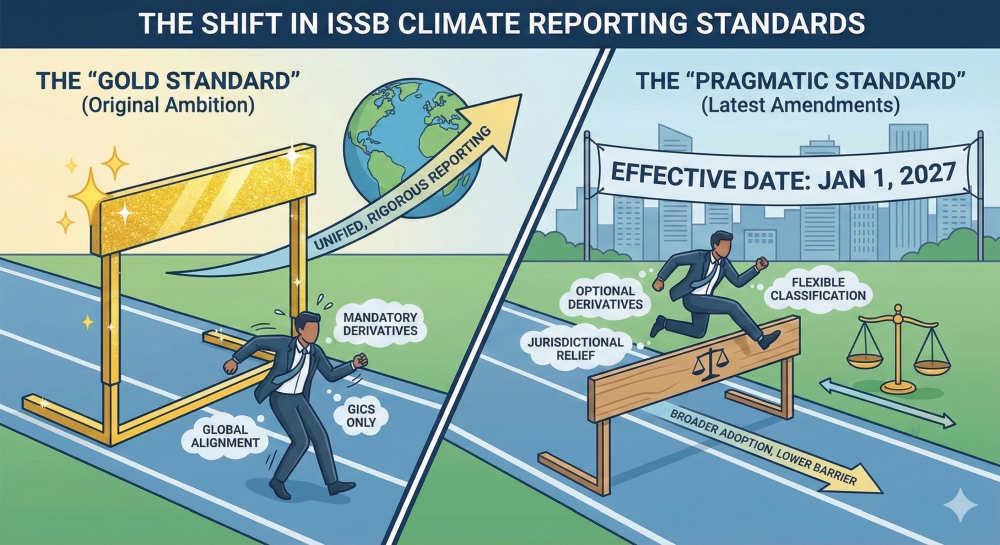

The ISSB was supposed to be the “Gold Standard” for climate reporting. Its latest amendments suggest it is settling for being the “Pragmatic Standard.”

For the past two years, the International Sustainability Standards Board (ISSB) has marched under a single, ambitious banner: the “Global Baseline.” The goal was to create a unified, rigorous language for carbon accounting that would force capital markets to treat CO2 with the same reverence as ROI.

But a quiet letter sent to software licensees this week suggests that the march has encountered the muddy reality of the back office.

In a move framed as “targeted amendments” to IFRS S2, the ISSB has announced significant reliefs that will roll out in data packages by early 2026. While the official communique cites a desire to “reduce complexity” and “lower costs,” the subtext is clear: the board is blinking in the face of operational difficulty. For banks, insurers, and asset managers, the carbon ledger just got significantly easier to balance and perhaps a little more opaque.

The Derivatives Loophole: Derivatives & Underwriting Excluded

The most striking concession strikes at the heart of modern finance: Scope 3, Category 15 (Financed Emissions).

Until now, the ambition was to capture the carbon footprint of every dollar moved by a financial institution. However, the new amendments offer a tantalizing “relief.” Entities can now limit their disclosures strictly to financed emissions (loans and investments).

The implications of what is now excluded are massive:

- Derivatives: The multi-trillion-dollar derivatives market—often criticized as a dark pool for carbon leakage—is effectively being given a pass.

- Facilitated Emissions: Investment banks underwriting bond issuances for oil majors or heavy industry (without holding the loan on their own books) need not count those emissions in their mandatory baseline.

- Insurance: Underwriting emissions are also out of the mandatory scope.

While banks can still disclose these figures if they wish, the amendment turns a mandate into a menu. For the “Licensees” receiving this data this creates a significant blind spot. A bank could technically facilitate billions in fossil fuel expansion via underwriting and derivatives, yet report a slimming carbon waistline on its loan book.

The GICS Monopoly Crumbles: New Flexibility for Banks

For years, the Global Industry Classification Standard (GICS), maintained by MSCI and S&P, has been the lingua franca of sector analysis. IFRS S2 previously mandated its use for disaggregating financed emissions.

That monopoly is officially over.

The amendments now permit commercial banks and insurers to use “alternative classification systems,” provided they meet certain “guardrails.”

- The upside: Financial institutions can use internal taxonomies that match their risk engines.

- The downside: Comparability, the holy grail of the ISSB, takes a hit. If Bank A uses GICS and Bank B uses a proprietary internal model or a jurisdictional alternative (like NACE in Europe), comparing their exposure to “Energy” becomes an exercise in apples-to-oranges translation.

Jurisdictional Relief: Why Local Rules Now Trump Global Standards

Perhaps the most telling aspect of the amendments is the “Jurisdictional Relief.”

The ISSB is acknowledging a fractured geopolitical landscape. If a local regulator or exchange requires a specific measurement method (deviating from the GHG Protocol) or specific Global Warming Potential (GWP) values (ignoring the latest IPCC report), the ISSB will now accept it.

This is a concession to the “Soup of Alphabets” (SEC, CSRD, various Asian taxonomies) that the ISSB was meant to replace. Instead of overriding local rules, IFRS S2 is now designed to wrap around them.

Impact on SASB Standards and Transition Timeline (2027)

For the data vendors and software providers receiving this notice, the clock is ticking, though not loudly.

- Data Delivery: Early January 2026.

- Effective Date: Annual periods beginning 1 January 2027.

This 12-month runway allows the ecosystem to retool. The “Data Industrial Complex” must now update SASB definitions for Commercial Banks, Asset Management, and Insurance to reflect a world where carbon accounting is slightly less granular than promised.

The Verdict

These amendments are likely to be cheered in boardrooms from London to New York. Calculating the carbon footprint of a complex derivative portfolio is a nightmare of methodology; removing it from the mandatory list is a victory for pragmatism.

However, for the purists hoping IFRS S2 would force a “Come to Jesus” moment for financial engineering, this is a retreat. The ISSB has chosen width over depth—securing broader adoption by lowering the barrier to entry. The Global Baseline is intact, but it has been lowered just enough for the heavyweights to step over it without tripping.