SASB

Sustainability Accounting Standards Board

The Sustainability Accounting Standards Board (SASB) is a non-profit organization established in 2011 to develop and maintain industry-specific standards that assist companies in disclosing financially material sustainability information to investors.

These standards focus on environmental, social, and governance (ESG) issues that are most relevant to financial performance within 77 distinct industries.

Read more

Understanding SASB

SASB Standards are designed to identify sustainability-related risks and opportunities that could reasonably be expected to affect an entity’s cash flows, access to finance, or cost of capital over the short, medium, or long term.

By providing a framework for consistent and comparable reporting, SASB enables organizations to communicate decision-useful information to investors.

Who can apply this Framework?

SASB Standards are designed for use by companies of all sizes and across all industries seeking to provide investors with material, industry-specific sustainability information. They are particularly beneficial for publicly listed companies aiming to enhance transparency and meet investor expectations regarding ESG disclosures.

Universal or local?

TCFD is a globally recognised framework and has been adopted in over 95 jurisdictions. Its recommendations are voluntary but have been incorporated into regulation or stock exchange requirements in countries such as the United Kingdom, Japan, New Zealand, Singapore, Switzerland, and the European Union.

Read more

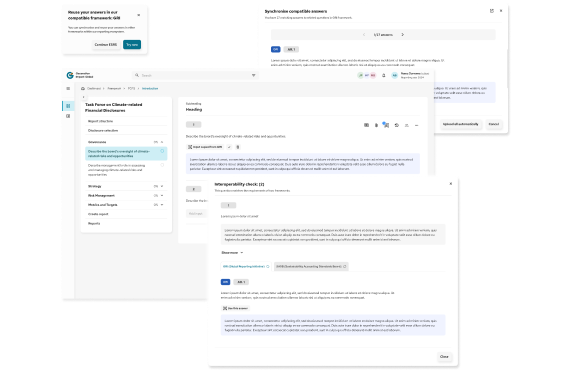

Generation Impact Global and SASB

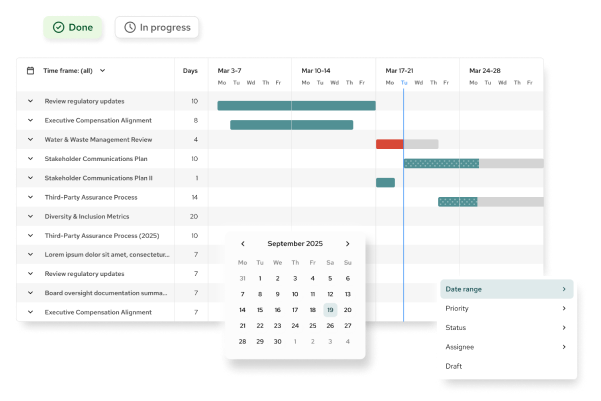

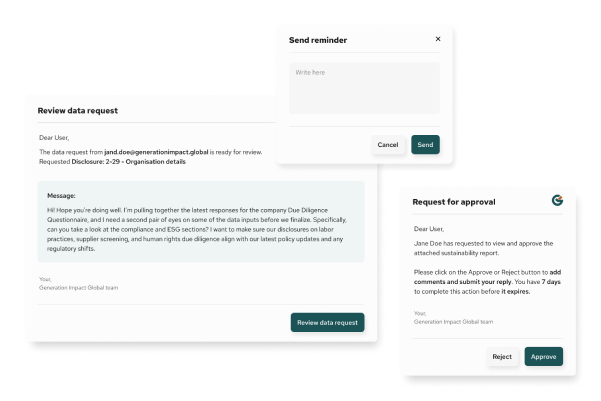

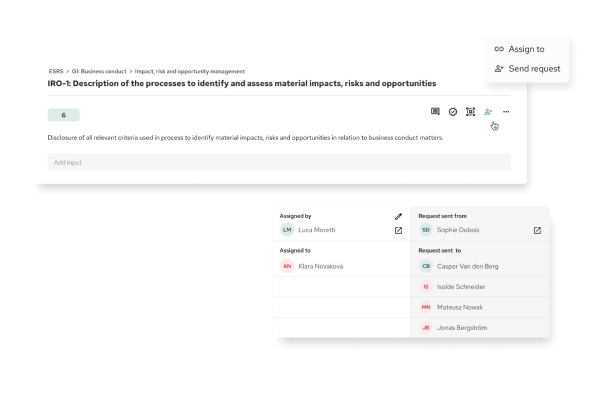

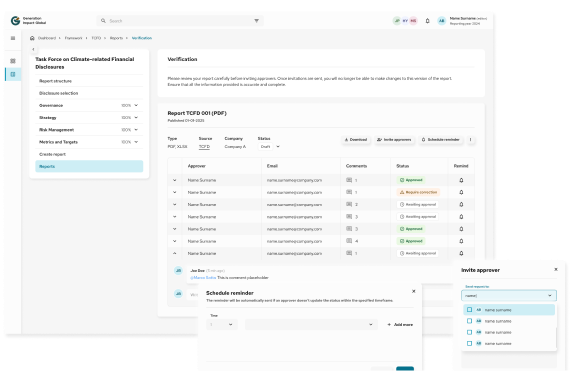

Our SASB Tool helps you connect sustainability data to what matters most for your industry and investors. Easily collect, track, and share ESG info, export reports, and manage data across multiple frameworks—all in one place.

Go further by using our interoperability features to manage ESG data across multiple frameworks, saving time and maintaining consistency in reporting materials.

Praise and recognition for SASB

Endorsed by public and private entities

SASB Standards are globally applicable. They are utilized by over 3,200 companies across more than 80 jurisdictions worldwide, including 75% of the S&P Global 1200 Index. This widespread adoption reflects the standards’ relevance and adaptability across different regulatory environments and market contexts.

1. How to use?

Identify applicable industry standards

Determine the industry or industries that align with your business operations using SASB’s Sustainable Industry Classification System® (SICS®).

Review disclosure topics and metrics

Examine the SASB Standards for your identified industry to understand the relevant disclosure topics and associated accounting metrics.

Assess materiality

Evaluate which sustainability issues are financially material to your company, considering factors such as impact on cash flows, access to finance, and cost of capital.

Collect data and disclose information

Gather the necessary data and incorporate SASB-aligned disclosures into your financial filings or sustainability reports.

2. Benefits

Implementing SASB Standards for disclosing an organization’s activities offers numerous benefits, including the following:

Investor communication

Provides investors with consistent, comparable, and reliable information on sustainability factors that are material to financial performance.

Read moreRisk management

Identifies and addresses sustainability-related risks that could affect the company’s financial health.

Competitive advantage

Demonstrates a commitment to transparency and sustainability, potentially leading to improved reputation and stakeholder trust.

Key features

Frequently Asked Questions

General Questions

1. Are SASB Standards mandatory?

While not legally mandated, many companies voluntarily adopt SASB Standards to meet investor expectations and enhance transparency in sustainability reporting.

2. How do SASB Standards differ from other sustainability frameworks?

SASB Standards are industry-specific and focus on financially material issues, whereas other frameworks may take a broader approach to sustainability reporting.

3. Can SASB Standards be used alongside other reporting frameworks?

Yes, companies often use SASB Standards in conjunction with other frameworks, such as the Global Reporting Initiative (GRI), to provide a comprehensive view of their sustainability performance.

4. Does the tool support version control and audit trails?

Yes. Our SASB solution offers full version history, role-based permissions, and audit logging, enabling collaboration, transparency, and governance over disclosure content.

5. How does the SASB tool help in responding to investor ESG requests?

With structured and comparable data aligned to SASB Standards, the tool helps you generate consistent ESG disclosures that meet investor expectations and simplify ESG data responses to rating agencies.

6. Is the SASB tool suitable for both SMEs and large enterprises?

Yes. Whether you’re a growing company or a multinational, our tool scales according to your reporting needs. Templates, workflows, and industry standards are customisable for different organisational sizes.

7. Do you offer support and training for using the SASB tool?

We do. Our team provides onboarding, training sessions, and ongoing technical support to ensure your team confidently uses the tool for efficient and compliant SASB reporting.