The Sustainable Finance Disclosure Regulation (SFDR) reporting tool

Generation Impact Global is proud to release the newest version of their SFDR Reporting Tool to enhance automation adoption and meet compliance requirements easier.

What is SFDR and why does it matter?

The Sustainable Finance Disclosure Regulation, is an EU regulation aimed at increasing transparency and standardization in sustainability-related disclosures by financial market participants.

SFDR enables companies to promote transparency around sustainability risks and impacts in investment decisions. By disclosing how environmental, social, and governance (ESG) factors are integrated into their processes, companies can build trust with investors, comply with EU regulatory requirements, and attract sustainability-focused capital. SFDR reporting also helps firms identify and manage long-term risks, align with global climate goals, and demonstrate their commitment to responsible business practices.

Read more

Our approach integrates:

PAI

Principal adverse sustainability impacts statement.

Article 8

Pre-contractual disclosure for the financial products referred to in Article 8, paragraphs 1, 2 and 2a, of Regulation (EU) 2019/2088 and Article 6, first paragraph, of Regulation (EU)

Article 9

Pre-contractual disclosure for the financial products referred to in Article 9, paragraphs 1 to 4a, of Regulation (EU) 2019/2088 and Article 5, first paragraph, of Regulation (EU) 2020/852

Get the SFDR White Paper

Obtain a deeper understanding of the Sustainable Finance Disclosure Regulation (SFDR) with our comprehensive guide. This white paper is your go-to resource for actionable insights and practical steps to meet ESG reporting requirements with ease. We’ll only use your email to send the PDF—nothing more.

- Brief

- Introduction

- Policy making timeline

- Scope and application of SFDR

- Regulatory Technical Standards (RTS) and amendments

- Principal Adverse Impacts (PAI) Statement

- Overview

- Key-components

- Division of SFDR indicators

- Key deliverables

- Key-components

- Example if SFDR Fund Classifications

- Qualitative data requirements

- Disclosure topics

- Data aggregation

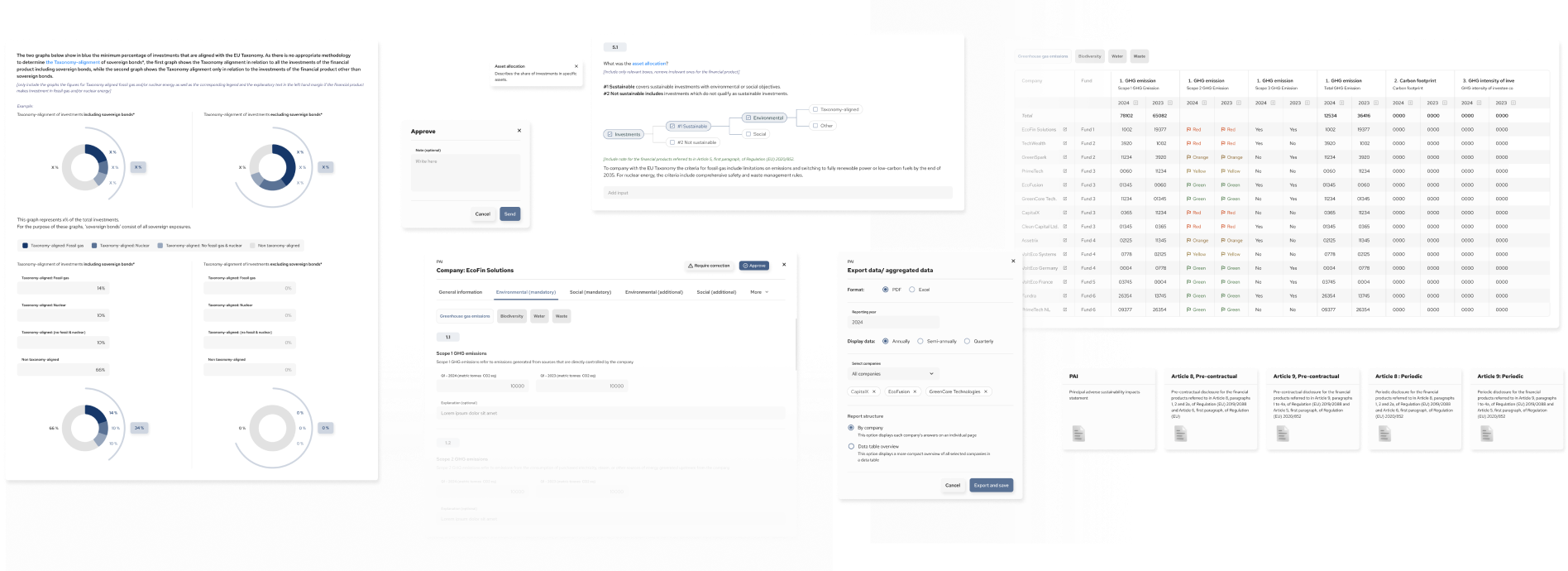

SFDR Reporting Tool

Collect – Calculate – Aggregate – Report

Generation Impact Global has been a leading provider

of non-financial data management tools for years and is gearing

up for the release of the latest updates to their SFDR tools.

These updates will give financial institutions access to even more advanced tools that can be used to tackle regulatory compliance

and manage non-financial data.

Key benefits

Full automatisation

Data aggregation and PAI calculation

PAI regulatory report

Portfolio Companies included

Centralised data collection

Unlimited seats

“This new version of our SFDR tool is a game-changer for financial institutions seeking an automated, accurate, and scalable solution to meet SFDR obligations,” said Anna Shpak, CEO of Generation Impact Global. “With full automation and built-in PAI compliance, we are helping companies navigate complex ESG reporting with ease.

The improved SFDR tool is now accessible worldwide and is increasingly attracting progressive financial institutions that emphasise both compliance and innovation.

Explore Our Platform – Book a Demo

Discover the full potential of our platform.

Schedule a personalised demo or connect with our ESG experts to answer your questions. We are here to provide help and support every step of the way.

Missed It Live? Watch it On-Demand

SFDR in practice: tackling PAI, articles 8 & 9 with Legance

Follow our SFDR Series webinar sessions featuring expert speakers tackling the most common questions around SFDR.

Past webinars